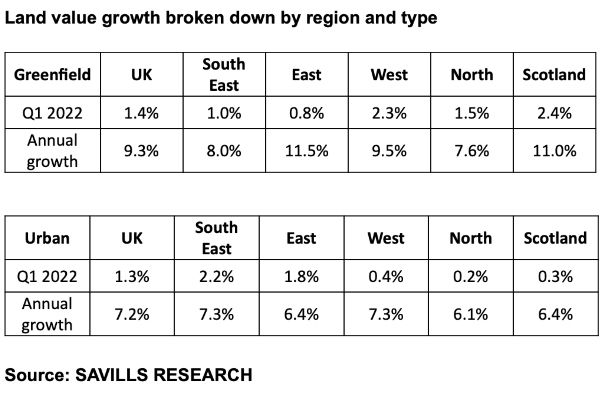

New research by Savills shows that greenfield land values in the East of England have outperformed the national average and risen faster than any other region in the UK in the last year.

Agents say high levels of demand coupled with constrained supply have led to the increase – with housebuilders willing to bid competitively for sites in order to secure their pipelines.

According to the research greenfield sites in the East of England have seen average price growth of 11.5 per cent in the last year – with growth of 0.8 per cent in the first quarter of 2022.

The annual growth is the highest of any region in the UK and outstrips the national average of 9.3 per cent.

Urban land values meanwhile have increased by 6.4 per cent over the last 12 months and by 1.8 per cent in the last quarter. This compares to a national average of 7.2 per cent in the last year.

Richard Janes, who leads the development team at Savills in Cambridge, said: “Build cost inflation continues to serve as a downward pressure on land values – however, its impact is relatively limited, offset by ongoing house price growth and the supply/demand imbalance.

“Major housebuilders continue to be the most competitive in the land market, with many still having surplus money to spend and requiring land to plug gaps in their immediate pipelines, especially given that many sites are already significantly forward sold for 2022. However smaller and medium-sized players are also very active.

“Interestingly we have also been seeing interest from alternative uses. Demand from industrial and logistics developers for example has been high in some parts of the region – putting even more pressure on constrained residential land supply. Strong prices are being paid for well-connected sites close to major road networks and motorway junctions.”

Richard Shuldham, senior surveyor at Savills in Norwich, said the shortage of land has been further compounded by 42 additional local authorities identified by Natural England as having to demonstrate nutrient neutrality on sites – including those in Norfolk.

“All local authorities in Norfolk are affected to some degree by the nitrate neutrality issue but the Greater Norwich Local Plan area – including Norwich, South Norfolk and Broadland – has been hit particularly hard as the inspector seeks clarity on the impact of the regulations on housing delivery.”

Richard added that while limited supply of land coming through the planning system is currently driving intense competition for sites, capacity for future price growth may be limited.

“Over the next five years we anticipate slowing growth in land values,” he said. “Our research shows greenfield land value is forecast to grow by just 4.4 per cent over the next five years.”

Image source: Savills

© Eastern Echo (powered by ukpropertyforums.com).

Sign up to receive your free bi-weekly Eastern Echo journal here.