Improved sentiment among housebuilders is driving some green shoots of recovery in the East of England development land market, according to Savills.

Quarterly analysis by the property giant shows demand remains strong for development sites across the region – although activity varies depending on location and type of site.

Richard Janes, head of development at Savills Cambridge (pictured left), said more housebuilders appeared to be returning to the market, encouraged by an improvement in new home sales rates, supported by a moderation in build costs and greater stability in the wider housing market.

However, the levels of demand continue to vary according to location, with optimum sites in primary areas, which guarantee scale and certainty of delivery, in highest demand.

“In general there have been more active players in the market and we have certainly seen an uptick in both sites and bids received,” Richard said.

“There’s still a sense of caution as many housebuilders remain quite selective, but there are definite signs of some green shoots of recovery.

“There remains a strong preference for deferred payments and conditional deals, while consented sites in primary and secondary locations – with planning already agreed in principle and good transport links to key towns and cities – are the most popular.”

There also continues to be challenges in Norfolk where nutrient neutrality is impacting new build delivery rates.

Richard Shuldham, associate in the development team at Savills Norwich, covering Norfolk and Suffolk (pictured right), said: “Fortunately, there is some light at the end of the tunnel as a number of private credit schemes are beginning to emerge, and some private development specific mitigation is winding its way through the local planning system.

“However the picture remains complicated. Large areas of the catchment are still unmitigated, and where there is mitigation, it is in short supply. In addition to the number of planning permissions being down, there also appear to be fewer applications being made.

“As a result, in the short term, any fluidity in the credit market is only likely to trickle down to the land market, rather than cause a large surge in developable sites coming through.”

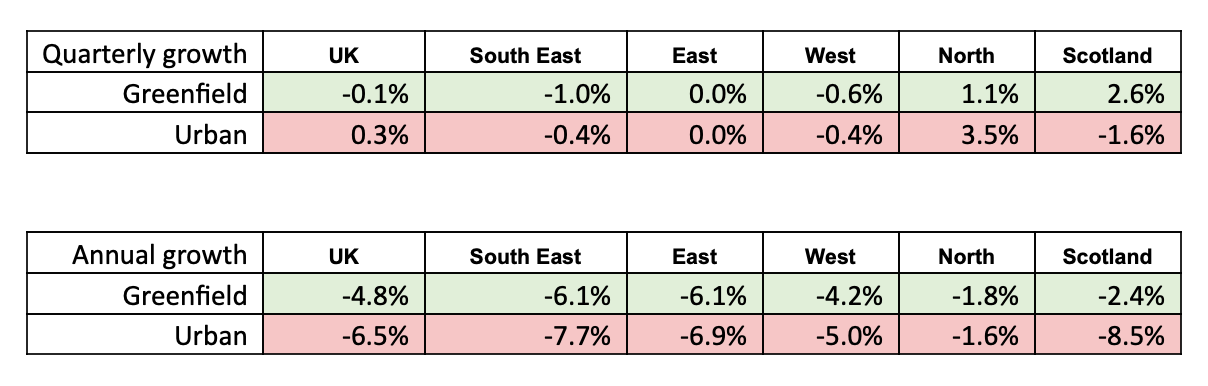

According to the Savills quarterly development land index there has been no change in the average value of either greenfield or urban development sites in the East of England since the start of this year.

Compared to the same period in 2023, however, values have fallen by 6.1 per cent and 7.7 per cent respectively. This compares to a national fall of 4.8 per cent for greenfield sites and 6.5 per cent for urban sites.

Richard Janes continued: “Average land values appear to be stabilising and – while to some extent this can be attributed to a shortage of sites underpinning activity – it shows just how resilient the development land market has been in this part of the world.

“The key question is whether this recent improvement in sentiment represents a more sustained recovery or whether it simply reflects a short-term release of latent demand.

“Despite a looming General Election, we do still expect a steady but limited stream of new sites to come onto the market. Activity will also continue to recover if housing market conditions remain stable and we start to see interest rate cuts, thus easing affordability pressures for buyers.

“If private sales rates stabilise and we see an uptick in buyer demand in line with the spring selling season, we would expect to see more activity from housebuilders which will support the completion of deals.”

House prices grew by 1.6 per cent in the 12 months to March 2024, according to Nationwide, and improved mortgage conditions since the start of the year boosted activity, with mortgage approvals in February reaching their highest level in 17 months.

Alongside this, private new build sales rates for the housebuilders have also seen a modest uptick since the start of the year, reaching around 0.6 per outlet per week in March 2024.

Build costs have continued to moderate as a result of falling demand and reduced construction output. According to BCIS, tender prices increased by 2.9 per cent in the year to Q1 2024 compared to 8.6 per cent in the previous year.

Chart below illustrates the change in development land values – greenfield and urban sites.

© Eastern Echo (powered by ukpropertyforums.com).

Sign up to receive our weekly free journal, The Forum here.