Knight Frank has reported that South East office market saw a record-breaking £4.02 billion in investment turnover in 2021.

This figure is more than double that of 2020, which stood at £1.93bn, and is 45 per cent above the 10-year average for the region. 2021 also saw a record Q4, which saw £1.54bn of office stock traded.

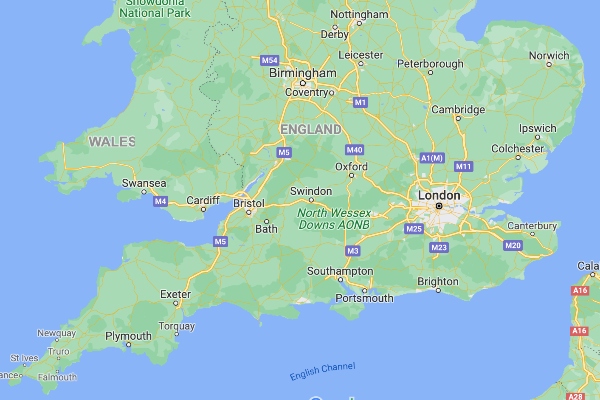

Foreign investment accounted for 59 per cent of transactions, driven by attractive price points and growth of the life sciences sector fuelling demand for high-quality space. Investor confidence in the golden triangle (Oxford, London and Cambridge) continued on its trajectory and saw over £1.5bn invested into offices, primarily by global private equity firms.

More than a third of all sales in the South East were of UK funds, as they continued to exit non-core assets and capitalise increased demand from alternative investments in some locations. Large numbers of investors targeted offices for repurposing opportunities into industrial space or data centres; £600m was allocated in Q4 with this intention.

The TMT sector (technology, media and telecom) drove leasing activity out of town, as office space take off reached 2.6 million sq ft across 171 deals; a 24 per cent increase compared with 2020. The TMT sector accounted for 29 per cent of the out of town take-up, its highest take up figure for 20 years. Fifty-four per cent of take-up were out of town in 2021, the highest percentage figure since 2015.

Nine deals were completed for offices of more than 50,000 sq ft by large corporates, the highest total since 2018. Vacancy stood at 6.9 per cent in the South East at the end of 2021, unchanged from 2020 and below the 10-year average of seven per cent, despite fears of a rise in supply.

The M4 corridor saw particularly strong demand, where 1.4 million sq ft was taken up, three times higher than the volume of 2020, with the 18,500 sq ft average being the highest since 2012. TMT companies remained dominant, accounting for 40 per cent of take up in the area.

Simon Rickards, head of South East capital markets at Knight Frank said “We expect the level of equity primed for investment into South East offices to remain high and potentially increase, as confidence in the sector continues to gather momentum. There will undoubtedly be a focus on prime fundamentals, ESG credentials and the ability to provide a best in class offering for occupiers, albeit with greater attention given to escalating refurbishment costs.

“The best multi-let offices will perform well going forward, but this will be to the detriment of secondary stock so further polarisation of the market will be evident in 2022. Interest in assets targeting the life sciences sector will be strong, with substantial levels of equity yet to be deployed. However, the biggest barrier to this sub-sector will continue to be a lack of suitable stock in the Golden Triangle.”

Emma Goodford, head of national offices at Knight Frank, said “The ESG and Sustainability agenda will continue to drive office relocations in 2022, as major corporates seek to meet ESG commitments to both employees and shareholders. At the same time, rising build costs and the lack of supply for new Grade A space will be key drivers of rental growth. The delayed development pipeline and limited availability has meant that larger occupiers are increasingly evaluating office requirements and turning to pre-letting opportunities.

“With life science workplace requirements expected to grow substantially, landlords and developers in Oxford and Cambridge must deliver schemes with offices and laboratory capability as well as incubation facilities to accommodate rapidly expanding businesses. The long-awaited arrival of the Crossrail will also create additional demand in key connected towns, with Maidenhead and Reading expected to benefit considerably in terms of office requirements.”

Image source- Google Maps.

© Eastern Echo (powered by ukpropertyforums.com).

Sign up to receive your free bi-weekly Eastern Echo journal here.